Insolvency Melbourne Can Be Fun For Anyone

Table of ContentsThe Best Strategy To Use For Bankruptcy Advice MelbourneOur Personal Insolvency PDFsWhat Does Personal Insolvency Mean?Some Known Factual Statements About Bankruptcy Advice Melbourne Our Bankruptcy Australia Diaries

As Kibler stated, a business needs to have a really excellent reason to restructure a great factor to exist as well as the rise of e-commerce has actually made merchants with substantial shop presences obsolete. 2nd possibilities might be a precious American suitable, but so is innovation and also the growing pains that come with it.Are you staring down the barrel of stating yourself insolvent in Australia? If you are facing financial challenge then you are not the only one. We comprehend that everyone can strike difficult times once in a while. This is no reason for somebody leading you down the path of proclaiming insolvency. Do not be sucked right into becoming part of a debt contract or stating bankruptcy.

We comprehend that every person deals with economic pressure at some point in their lives. In Australia, also households and organizations that seem to be prospering can experience unanticipated hardship because of life modifications, work loss, or elements that run out our control. That's why, below at Leave Financial Obligation Today, we provide you professional suggestions and examinations concerning real effects of bankruptcy, debt contracts as well as various other economic concerns - we desire you to return on your feet as well as remain there with the very best possible result for your future and also all that you desire to acquire.

How Bankruptcy Victoria can Save You Time, Stress, and Money.

It is worth noting that when it pertains to financial debt in Australia you are not the only one. Individual personal bankruptcies and also insolvencies are at a record high in Australia, impacting three times as lots of Australian contrasted to twenty years back. There is, nevertheless, no security in numbers when it pertains to stating insolvency and insolvency.

One point that several Australian individuals are uninformed of is that in actual fact you will be detailed on the Australian NPII for merely lodging an application for a financial obligation contract - Bankruptcy Australia. Lodging a financial obligation agreement is actually an act of proclaiming on your own bankrupt. This is a main act of insolvency in the eyes of Australian legislation even if your financial debt enthusiasts do not approve it.

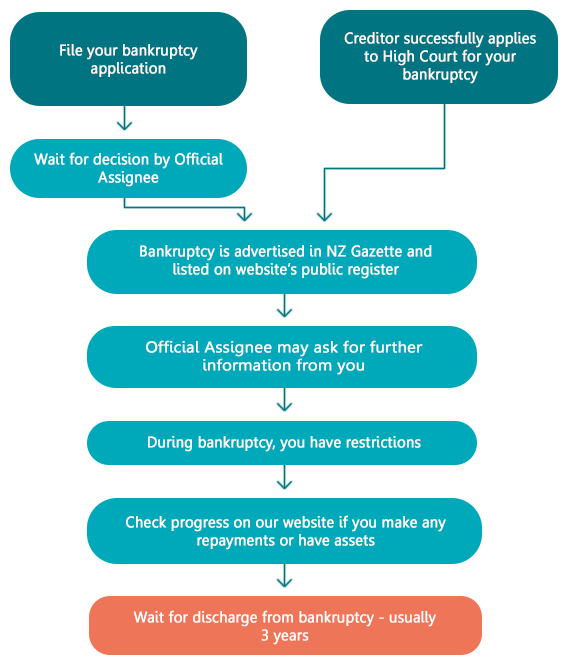

During and also after your personal bankruptcy in Australia, you have particular commitments and encounter specific restrictions. Any kind of lenders who are desiring to acquire a duplicate of your credit scores report can request this details from a credit score coverage company. Once you are stated bankrupt protected creditors, that hold safety and security over your property, will likely visit this website be entitled to take the home and also sell it.

The Facts About Bankruptcy Melbourne Revealed

a home or automobile) Once proclaimed bankrupt you have to notify the trustee right away if you become the recipient of a deceased estate If any one of your lenders hold legitimate security over any kind of building as well as they do something about find out this here it to recuperate it, you have to help You must surrender your ticket to the trustee if you are asked to do so You will certainly stay liable for financial obligations sustained after the date of your insolvency You will certainly will not be able to work as a director or supervisor of a company without the courts authorization As you can see becoming part of personal bankruptcy can have durable adverse effects on your life.

Participating in bankruptcy can leave your life in tatters, losing your residence and ownerships and leaving you with nothing. Prevent this end result by speaking to a financial debt counsellor today concerning taking a various rout. Insolvency requires to be effectively considered as well as prepared, you need to not ever enter insolvency on an impulse as it can have effects on you that you may not even recognize. Bankruptcy Melbourne.

We provide you the capacity to pay your debt off at a decreased rate as well as with lowered interest. We understand what creditors are trying redirected here to find as well as have the ability to discuss with them to provide you the very best opportunity to settle your financial obligations.

The Only Guide for Bankruptcy Victoria

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

What is the distinction between default and bankruptcy? Defaulting on a car loan indicates that you have actually breached the promissory or cardholder contract with the loan provider to make repayments on time.

Bankruptcy Advice Melbourne for Beginners

For example, if you fail on a vehicle funding, the loan provider will frequently try to retrieve the automobile. Unsecured debt, like charge card financial obligation, has no collateral; in these instances, it's more challenging for a collection agency to redeem the financial debt, however the agency might still take you to court and effort to place a lien on your residence or garnish your salaries.

The court will select a trustee that might liquidate or offer several of your belongings to pay your lenders. While most of your debt will be canceled, you may pick to pay some creditors in order to keep a car or home on which the lender has a lien, claims Ross (Liquidation Melbourne).

If you operate in a sector where companies check your credit as component of the working with procedure, it may be much more tough to obtain a new task or be advertised after insolvency. Jay Fleischman of Cash Wise Legislation claims that if you have credit scores cards, they will usually be closed as soon as you apply for bankruptcy.